Swiss motorbike market insights: mid-season review

- 2023-07-11

- Businesses

As we pass the mid-season mark, it’s time for our detailed insights about the state of the Swiss motorbike market. Read More

As we come to the end of the season, it’s time for our full analysis of the sales of new motorbikes in Switzerland.

A month ahead of schedule, it’s time for our detailed analysis of the Swiss market for 2023. As December is not historically a decisive month for new motorbike sales, we can outline some general trends.

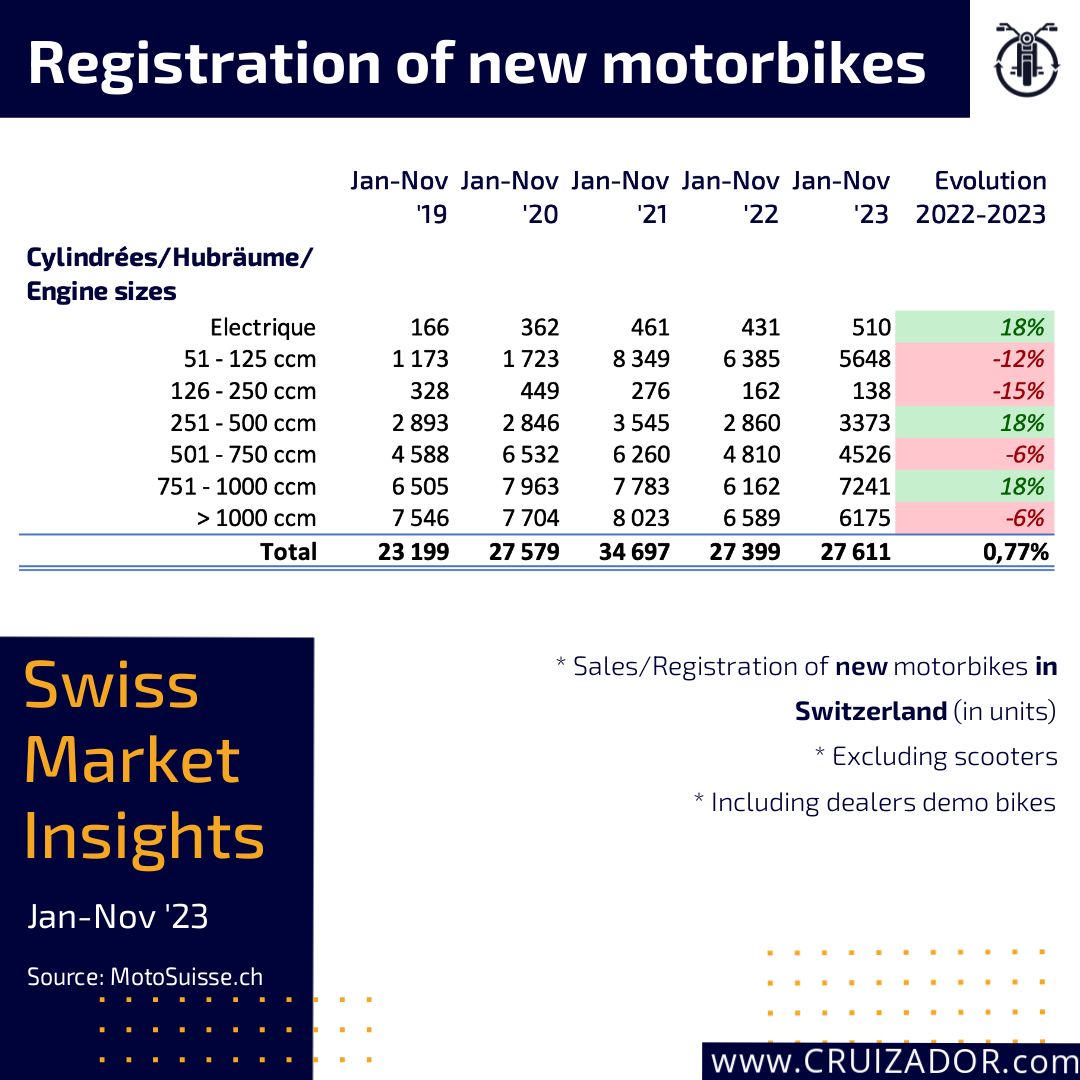

So what about the figures published by the umbrella organisation MotoSuisse for the first 11 months of 2023? Long story short, the results are mixed.

Consolidated over 11 months, registrations of new motorbikes were up slightly by 0.77%, across all brands and all engine sizes.

And while some brands are beginning to show signs of recovery, others are continuing to record sharp falls in sales.

Let’s get down to our detailed analysis, including trends over the last 5 years.

The following points can be made about sales by engine size. The 126-250 cc category continues to decline. After falling by 38% in 2022, it will continue to do so in 2023 (down 15%).

The mid-size category (500-1000 cc) is picking up again. After an average fall of 23%/-21% in 2022, the mid-size category is being pulled back into the green by the 751-1000 cm3 segment.

As for the top category (> 1,000 cc), it continues to plummet. After falling by 17% in 2022, it will fall by 6% in 2023.

For more details and comparisons, please refer to our 2022 season review.

sales new motorbikes Switzerland

sales new motorbikes Switzerland

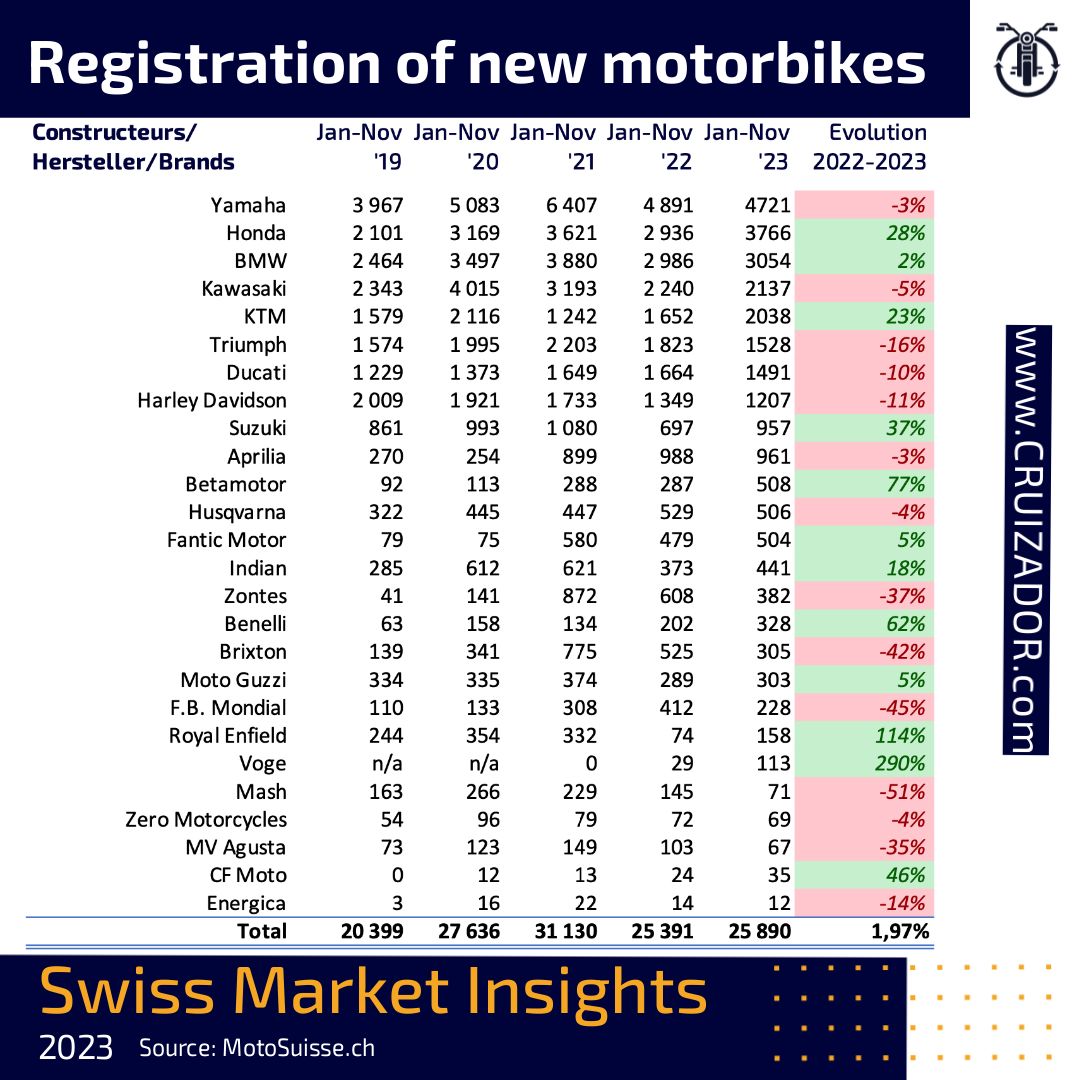

Now let’s take a closer look at the manufacturers. Some major manufacturers, such as Honda and Suzuki, are clearly recovering. It should be noted, however, that these brands recorded a sharp fall in 2022 (Suzuki -35%, Honda -18%, etc.). See our 2022 report.

Other manufacturers continue to see their sales fall, such as Triumph (-16%) and Ducati (-10%).

If we broaden the spectrum and look at the 5-year period, we can see very clearly that sales are returning to pre-pandemic levels.

In this respect, Harley Davidson’s 40% fall over the last 5 years is quite spectacular.

On the other hand, certain brands such as Aprilia (+256%), Benelli (+421%) and Honda (+79%) seem to be making a big comeback!

sales new motorbikes Switzerland

sales new motorbikes Switzerland

The Chinese manufacturers, for their part, are crossing swords and waging a fierce battle. None of them can hold a candle to their rivals.

Since they stand out mainly on price, are they targeting a slightly less captive/loyal clientele because they are mainly sensitive to the price argument?

Perhaps. However, if we look at the trend over 5 years, the figures speak for themselves:

To mention only a few. The only company to lose out was Mash (-56%), which seems to be losing its hegemony over Chinese production.

What’s more, these same manufacturers are also moving upmarket, offering, for example, fully-equipped mid-size trail bikes for under CHF 10,000, like Voge and its 900 DS adventure.

Should ‘Western’ manufacturers be worried? Only time will tell.

At least for newcomers to the world of motorcycling, who often have a limited budget when it comes to buying their first bike, and for whom historical references are not necessarily the deciding factor.

In fact, being able to benefit from the manufacturer’s warranty on a bike with a price tag of well under CHF 10,000 can be a very persuasive argument.

With 510 units registered in 2023, electric motorbikes are still struggling to convince motorcyclists.

Manufacturers such as Energica and Zero Motorcycles are announcing increased range, sometimes reaching around 400km in theory. However, with entry level prices sometimes well over 20,000CHF, it’s clear that they are aimed primarily at an elite clientele, who may even use them as a 2nd or 3rd motorbike.

Electric scooters, on the other hand, are beginning to appeal to an urban/suburban clientele who see these vehicles as an alternative to a 2nd car, for example. 3,308 electric scooters were registered in 2023.

Is the best-selling motorbike in Switzerland still the Yam MT-07? Drum roll…

No, this year’s top seller is the BMW GS 1250, with 911 units (down 8.99%).

That’s if you add up the ‘normal’ 1250GS and the 1250 GS Adventure. Yes, we don’t really see why this model is artificially segmented when other manufacturers are not.

The MT-07 remains on the podium, in 2nd place, with 877 units (-5.7%).

Then come

The final surprise was that the new Honda Transalp XL750 did not make it into the Top 20.

We thought that, with an aggressive pricing of less than 12,000CHF without options, it would become a massive hit. But it seems that the Ténéré 700 is retaining its hegemony in the mid-size trail segment.

Clearly, the underlying trend seems to indicate that the historic sales achieved during the pandemic are a thing of the past.

Faced with major challenges such as inflation, rising insurance premiums, rents and energy prices, Swiss households may no longer be prioritising the purchase of a new motorbike.

However, one thing is certain. Motorbike manufacturers are continuing to put pressure on dealers to meet their sales targets…

But should dealers be alarmed? No, especially when there are ready-to-use solutions at hand.

We prepared a case study to see if rental is a viable complement or alternative to sales.

But in summary, with a 20% booking rate over the season, thanks to a hybrid model consisting of

you can generate a minimum of 400% additional profitability compared to simple sales.

Don’t believe us? We can demonstrate this for you using 3 iconic models: Honda Africa Twin, Triumph Bonneville, HD Fat Bob.

And with a 30% reservation rate? Min 700% extra profitability!

Click on the links to find out more:

Registering up to 5 vehicles is free, will only take a few minutes and will allow you to evaluate this business opportunity seriously, without paying expensive IT development costs, while taking advantage of our tens of thousands of monthly organic visitors, with high purchasing power, who would be delighted to rent your vehicles.

What’s more, you’ll be able to engage your own clientele by offering them the high-quality content of our BLOG, on which we cover all aspects of motorcycling: road books, product tests, unusual places, good deals, etc.

To conclude, here are the main advantages you’ll find as a professional on Cruizador.

Want to find out more? Visit our dedicated section for professionals -> here <-, or click on the images below

We hope that this reading has been useful to you.

Thank you for your interest and see you soon for a new article!

Ride on !

sales new motorbikes Switzerland

Motorbike Swiss Market Insights

[…] trouverez une analyse détaillée du marché pour 2023 -> ici […]