New motorbike sales in Switzerland: 2023 season review

- 2023-12-12

- Businesses

As we come to the end of the season, it’s time for our full analysis of the sales of new motorbikes in…

Read More

As we pass the mid-season mark, it’s time for our detailed insights about the state of the Swiss motorbike market.

As usual, the umbrella organisation MotoSuisse has published the figures for new motorbike registrations in Switzerland for the 1st semester 2023. And the results are contrasted.

Consolidated over the 1st semester, sales of new motorbikes fell by 5,4% for all manufacturers and all engine sizes.

And while some brands are beginning to show signs of recovery, others continue to see their sales plummet. Which ones are they? We tell you more in our detailed analysis.

In terms of sales by engine sizes, apart from the small and medium categories, all sizes are down, and significantly so.

Motorbike Swiss Market Insights

Now let’s take a closer look at the manufacturers. Some major manufacturers, such as Honda, BMW and Suzuki, are showing signs of recovery. It should be noted, however, that these brands recorded a sharp fall in 2022 (BMW -21%, Honda -18%, etc.). See our 2022 market analysis.

Other manufacturers, such as Triumph (-23%) and Harley (-25%), have seen their sales plummet.

It would seem that the wave on which Chinese manufacturers have been riding in 2022 seems to be slowing down a little, with Zontes and F.B. Moto, for example, seeing their sales fall by 42% and 41% respectively.

In any case, we’re looking forward to seeing what happens between now and the end of the year, to see whether the current trends will be confirmed or reversed.

Motorbike Swiss Market Insights

Is the best-selling motorbike in Switzerland still the Yam MT-07? Drum roll…

Yes, with 579 units (-16.33%), it’s still the best-selling motorbike in Switzerland, followed by the BMW GS if you include the GS Adventure, with 574 units combined.

Then come

It is clear that in the face of major challenges, such as inflation or rising interest rates and energy prices, Swiss households may no longer consider the purchase of a new motorbike as a priority.

Here, all the techniques for offsetting declining sales seem to be worth trying.

Many are already offering leasing at preferential rates, or offering accessories or equipment (helmets, clothing, etc.). Others are experimenting with trade-in incentives. We’ve also seen offers such as a year’s free insurance with the purchase of a new vehicle.

But will this be enough, and above all, is a customer who cannot afford to buy and maintain his vehicle a good customer for a dealer, regardless of whether or not he is offered his/her insurance premium for a year? Dealers will be able to answer this question for themselves.

But one thing is certain. Manufacturers are continuing to put pressure on dealers to meet their sales targets…

But should dealers be alarmed? No, especially when there are ready-to-use solutions at hand.

We prepared a case study to see if rental is a viable complement or alternative to sales.

But in summary, with a 20% booking rate over the season, thanks to a hybrid model consisting of

you can generate a minimum of 400% additional profitability compared to simple sales.

Don’t believe us? We can demonstrate this for you using 3 iconic models: Honda Africa Twin, Triumph Bonneville, HD Fat Bob.

And with a 30% reservation rate? Min 700% extra profitability!

Click on the links to find out more:

Registering up to 5 vehicles is free, will only take a few minutes and will allow you to evaluate this business opportunity seriously, without paying expensive IT development costs, while taking advantage of our tens of thousands of monthly organic visitors, with high purchasing power, who would be delighted to rent your vehicles.

What’s more, you’ll be able to engage your own clientele by offering them the high-quality content of our BLOG, on which we cover all aspects of motorcycling: road books, product tests, unusual places, good deals, etc.

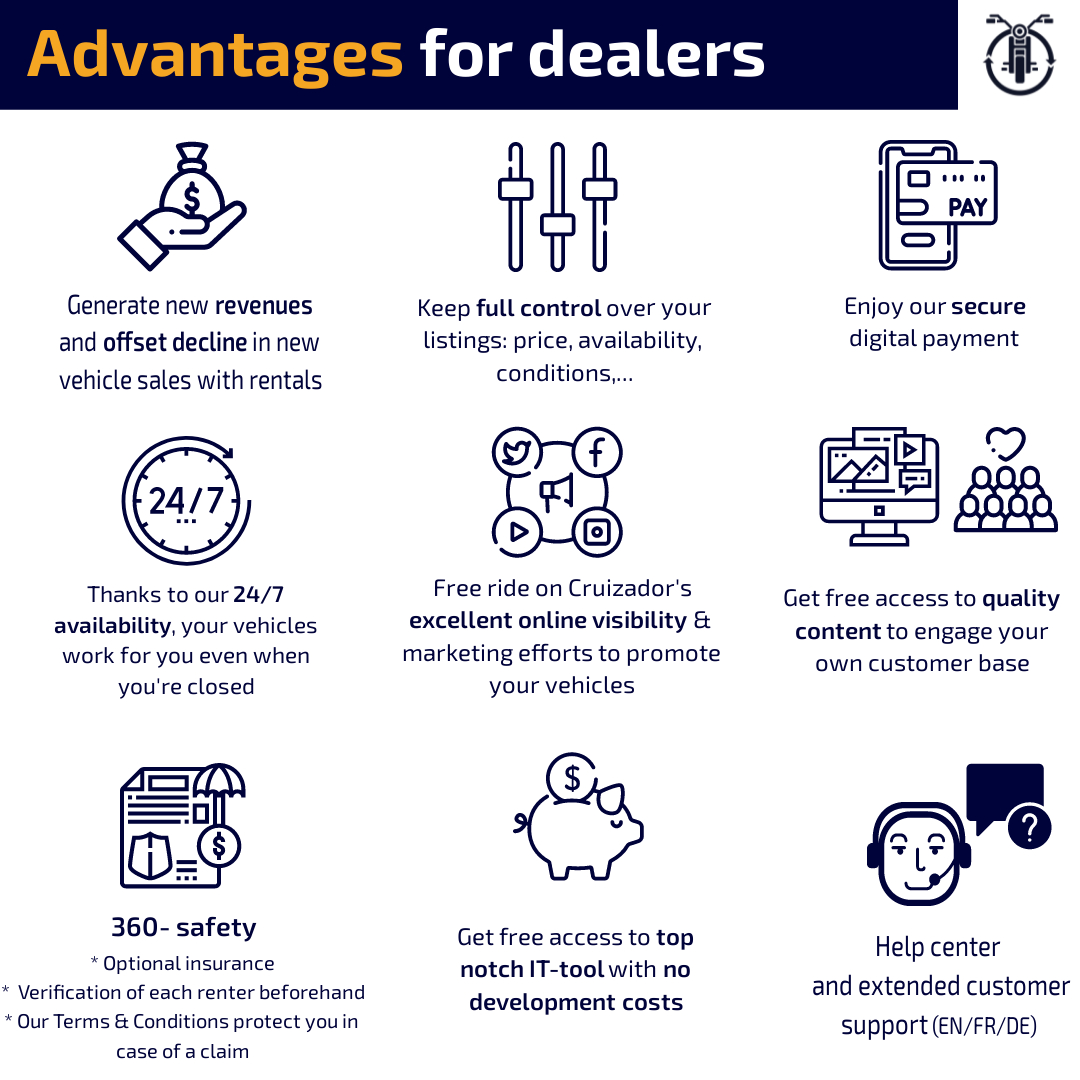

To conclude, here are the main advantages you’ll find as a professional on Cruizador.

Want to find out more? Visit our dedicated section for professionals -> here <-, or click on the images below

We hope that this reading has been useful to you.

Thank you for your interest and see you soon for a new article!

Ride on !

Motorbike Swiss Market Insights

[…] clindamycin 300 mg[…]

clindamycin 300 mg